Pooler Ga Property Taxes . Please note that we can only. The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of the taxing. During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. The board of tax assessors is responsible for property valuations, and the tax commissioner is responsible for collecting property taxes. Form submission portal read more. Property tax rates for overlapping governments. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. Please reach out to us. Evidence & property read more. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Evidence & property read more.

from decaturtax.blogspot.com

Please note that we can only. Form submission portal read more. The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of the taxing. The board of tax assessors is responsible for property valuations, and the tax commissioner is responsible for collecting property taxes. Please reach out to us. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. Evidence & property read more. Evidence & property read more. Property tax rates for overlapping governments. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

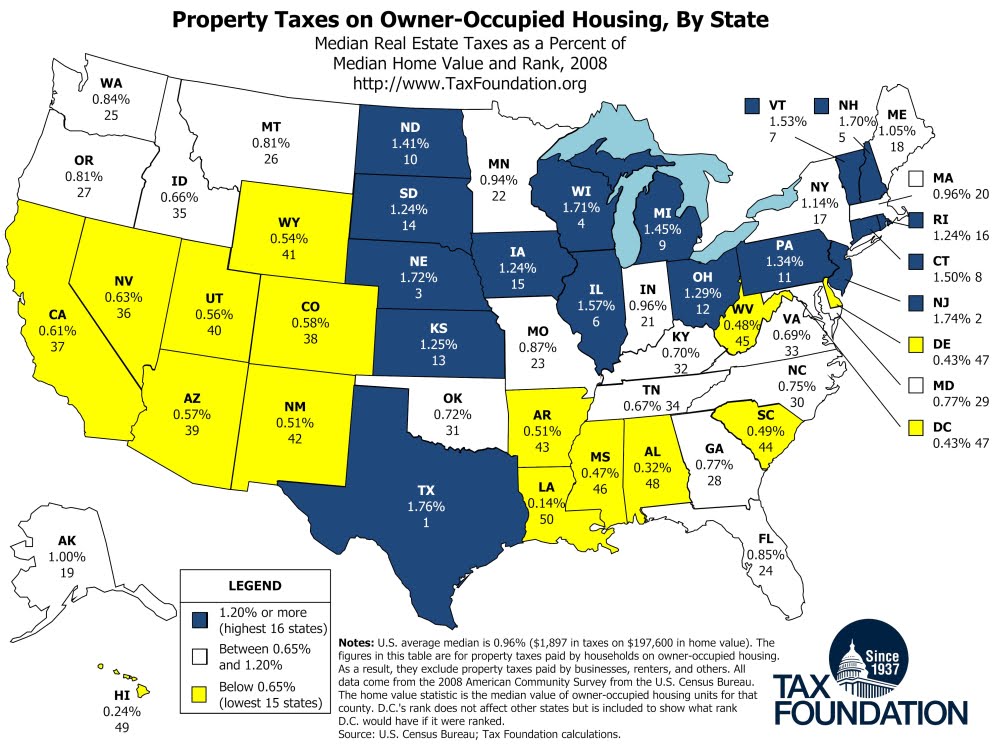

Decatur Tax Blog median property tax rate

Pooler Ga Property Taxes To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please reach out to us. The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of the taxing. Property tax rates for overlapping governments. During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. Please note that we can only. Evidence & property read more. Form submission portal read more. Evidence & property read more. The board of tax assessors is responsible for property valuations, and the tax commissioner is responsible for collecting property taxes. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most.

From www.loopnet.com

1513 Quacco Rd, Pooler, GA 31322 Quacco Road Development Opportunity Pooler Ga Property Taxes The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of the taxing. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only. The chatham county tax. Pooler Ga Property Taxes.

From www.robinlancerealty.com

Homes For Sale In Pooler, GA Robin Lance Realty Pooler Ga Property Taxes Property tax rates for overlapping governments. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. Evidence & property read more. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only.. Pooler Ga Property Taxes.

From fill.io

Fill Free fillable forms City of Pooler Pooler Ga Property Taxes Please note that we can only. Evidence & property read more. Property tax rates for overlapping governments. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most.. Pooler Ga Property Taxes.

From www.11alive.com

GA property tax proposed bill SB 349 Pooler Ga Property Taxes During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. Form submission portal read more. Please note that we can only. The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority. Pooler Ga Property Taxes.

From www.realtor.com

Pooler, GA Real Estate Pooler Homes for Sale Pooler Ga Property Taxes During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. Please reach out to us. The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of the taxing. The board of. Pooler Ga Property Taxes.

From www.pinterest.com

Chart 4 Local Tax Burden by County FY 2015.JPG Burden, Tax Pooler Ga Property Taxes Please reach out to us. Evidence & property read more. Evidence & property read more. Please note that we can only. Form submission portal read more. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. Property tax rates for overlapping governments. The board of tax assessors is responsible for property valuations, and. Pooler Ga Property Taxes.

From decaturtax.blogspot.com

Decatur Tax Blog median property tax rate Pooler Ga Property Taxes The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. Form submission portal read more. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. The board of tax assessors is responsible for property valuations, and the. Pooler Ga Property Taxes.

From www.realtor.com

Pooler, GA 5 Bedroom Homes for Sale Pooler Ga Property Taxes During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. The chatham county tax commissioner's office. Pooler Ga Property Taxes.

From www.realtor.com

Pooler, GA Real Estate Pooler Homes for Sale Pooler Ga Property Taxes Form submission portal read more. Please reach out to us. Evidence & property read more. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. Please note that we can only. Property tax rates for overlapping governments. Evidence & property read more. The tax rate, or millage, in each county is set annually. Pooler Ga Property Taxes.

From www.homesforsaleteam.com

Moving To Paulding County GA Here Is The Senior Exemption You Need To Pooler Ga Property Taxes Form submission portal read more. During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. To calculate the exact amount of property tax you will. Pooler Ga Property Taxes.

From www.realtor.com

Pooler, GA Real Estate Pooler Homes for Sale Pooler Ga Property Taxes The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. The board of tax assessors is responsible for property valuations, and the tax commissioner is responsible for collecting property taxes. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on. Pooler Ga Property Taxes.

From www.ezhomesearch.com

The Ultimate Guide to Property Tax Laws in Pooler Ga Property Taxes Please reach out to us. During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. Evidence & property read more. Form submission portal read more. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most.. Pooler Ga Property Taxes.

From www.realtor.com

Pooler, GA Real Estate Pooler Homes for Sale Pooler Ga Property Taxes The board of tax assessors is responsible for property valuations, and the tax commissioner is responsible for collecting property taxes. Please reach out to us. The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of the taxing. Evidence & property read more. To calculate the exact amount of. Pooler Ga Property Taxes.

From www.realtor.com

Pooler, GA Real Estate Pooler Homes for Sale Pooler Ga Property Taxes Form submission portal read more. The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of the taxing. Please reach out to us. The board of tax assessors is responsible for property valuations, and the tax commissioner is responsible for collecting property taxes. During the 2023 legislative season, georgia. Pooler Ga Property Taxes.

From www.realtor.com

Pooler, GA Real Estate Pooler Homes for Sale Pooler Ga Property Taxes Evidence & property read more. The chatham county tax commissioner's office and board of assessors makes every effort to produce the most. During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. Evidence & property read more. Property tax rates for overlapping. Pooler Ga Property Taxes.

From www.realtor.com

Pooler, GA Real Estate Pooler Homes for Sale Pooler Ga Property Taxes The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of the taxing. The board of tax assessors is responsible for property valuations, and the tax commissioner is responsible for collecting property taxes. Please reach out to us. Property tax rates for overlapping governments. During the 2023 legislative season,. Pooler Ga Property Taxes.

From thecolumbusceo.com

Property Taxes Are 16.8 Of Tax Revenue, Above U.S. Average Pooler Ga Property Taxes Evidence & property read more. During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. Evidence & property read more. The tax rate, or millage, in each county is set annually by the board of county commissioners, or other governing authority of. Pooler Ga Property Taxes.

From www.propertyshark.com

101 Lakes Industrial Blvd, Pooler Industrial Space For Lease Pooler Ga Property Taxes Evidence & property read more. During the 2023 legislative season, georgia lawmakers passed sb 215, hb 311, hb 138,and hb 18 which makes changes to property tax law that may affect taxpayers in. Form submission portal read more. Please note that we can only. Evidence & property read more. Please reach out to us. The board of tax assessors is. Pooler Ga Property Taxes.